An Islamic loan is a usury-free loan obtained from an Islamic bank. The Muslim may cite the law of necessity is used as justification.

An Islamic loan contains no interest (usury) in any shape or form, except when the law of necessity is used as justification to purchase a home. Often, an Islamic Loan will end up costing more than a regular interest-bearing loan (averaging 1% more) due to the complications surrounding the overall setup of an Islamic loan. It is important to understand the guidelines established by the Sharia before accepting an Islamic loan from a non-Islamic bank or government.

Many banks are digging deep and setting up Islamic-type loans to attract business and make money off of Muslims who have no other way to purchase a home. Some Muslims have become consumed by the ways of the world instead what the Quran and hadith (words and deeds of Prophet Mohammad).

What is an Islamic Mortgage?

An Islamic mortgage is one that is open to everyone, not just Muslims. A true Islamic mortgage will come from a halal (Islamic Bank) that never deals with any type of interest, including on checking accounts. An Islamic mortgage deals with the two main kinds of Islamic mortgages called:

● Ijara Declining Rent Agreement

● Murahaba Islamic Mortgage

What is Usury?

Usury is an Islamic term for interest. Interest is forbidden in Islam and it's regarded as one of the worst sins. Muslims are not allowed to receive interest, nor can they pay interest. Therefore, Muslims cannot charge interest to anyone, nor can they accept interest garnered from an interest-bearing checking account, for instance. In Islam, all forms of interest must be avoided.

Islamic Financing Fatwas

There are many fatwas — legal pronouncements in Islam — and not all fatwas are legitimate. The sharia has stated that interest is haram (forbidden) and that it leads to the hellfire. They also said, that usury should be avoided in every possible way, and yet some have developed a different interpretation of this particular fatwa. Some Sheiks are telling members that using an Islamic mortgage is okay if:

● the Muslim does not like his present home;

● the Muslim is unable to move to a new home; or

● the Muslim is desperate to buy a home and cannot save the money.

They go further to state that a loan with mortgage is acceptable if the individual's need is extreme and local banks fail to offer an Islamic mortgage program. Other Muslims firmly believe that this contradicts Islamic belief, arguing that it goes against the very hadith that warns Muslims to stay away from interest. It's widely believed that Muslims should never borrow from a bank where the word "interest" is used.

According to Abu Hurayrah, "Allah's Messenger (peace be upon him*) said, 'On the night when I was taken up to Heaven I came upon people whose bellies were like houses and contained snakes which could be seen from outside their bellies. I asked Gabriel who they were and he told me that they were people who had practiced usury." (Al-Tirmidhi Hadith 2828)

The Law of Necessity Excuse in Islamic Financing

According to a group of scholars in Detroit, headed by Dr. Yusuf Qardawi, Muslims may purchase a home with an interest-bearing mortgage if it is deemed an emergency or necessity. It's said that Muslims must first try to buy a home through every other means possible. Those means would include:

● Ijara declining a rental agreement

● Murahaba Islamic mortgage

● Seller financing

● Lease option

● Borrowing from family and friends

Many Muslims are flocking to non-Islamic banks and governments to purchase homes, just because the phrase "Islamic financing" is mentioned. A true Islamic loan cannot be obtained through any bank that deals in interest. The purchasing of a home must be based on the same premise as having a checking account or a savings account. .

It is important to differentiate between a family being in danger and necessity. The Muslim must consider whether it's a necessity to own a home or whether it's merely the shaitan (devil) tempting him or her to imitate the non-believers? As in all things, it's believed that Muslims should pray salat ul Istikhara before making any decision and then depend on Allah for the guidance.

Purchasing a home in any society must be a choice that devout Muslims ask carefully. Desiring beautiful homes to compete with the "Jones" must be weighed against the desire to follow Islam and its teachings. Is it wrong to purchase a home in today's times? This is something only Allah can answer.

* Muslims invoke Allah's blessings on the Prophet Muhammad whenever this name is mentioned.

Resources:

MacCharles, Tonda, (January 20,2008) "Muslim Leader Calls Sharia Loans a Con Job," The Star. Retrieved August 7, 2010.

Wiseman, Paul (March 28, 2008) "Islamic Loans turn profit for banks in the USA" in USA Today.

Retrieved August 7, 2010.

Watkins, Simon (July, 15, 2003) "Keeping the Faith" on ThisIsMoney.com. Retrieved August 7, 2010.

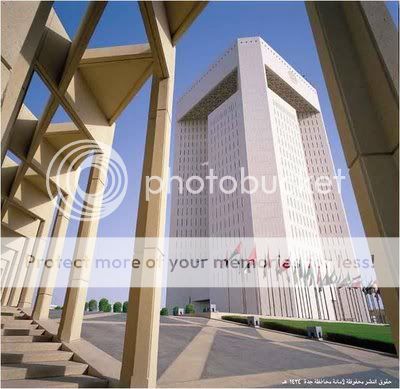

Photo courtesy of Photobucket: awibisino